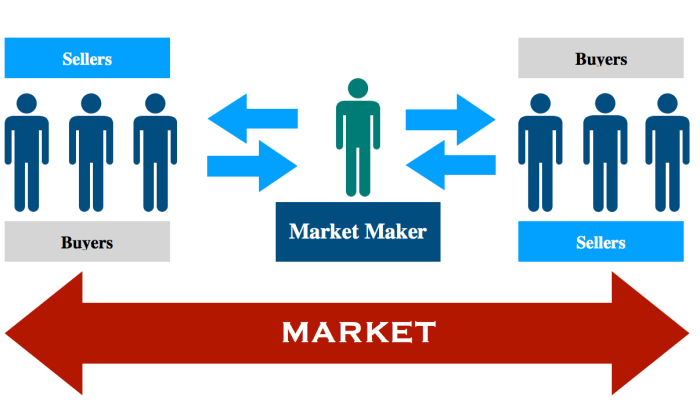

If a market maker posts a quote of 10.00, it signals their willingness to buy or sell a specific security at that price. This action can significantly impact the market, influencing liquidity, depth, and even prices. Understanding the significance of market maker quotes is crucial for market participants.

Market makers play a vital role in maintaining market efficiency and providing liquidity. Their quotes provide a reference point for traders, facilitating order execution and price discovery.

Market Maker Quote

When a market maker posts a quote of 10.00, it signifies their willingness to buy or sell an asset at that price. This quote provides a reference point for other market participants and can have a significant impact on the market.

A market maker’s quote can influence the market by establishing a price range within which the asset is likely to trade. It also provides liquidity, allowing investors to enter or exit positions quickly and efficiently.

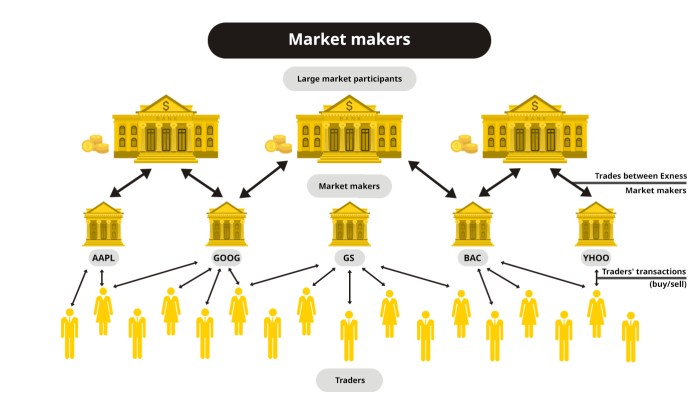

Types of Market Makers

- Dealer Market Makers: These market makers hold an inventory of assets and quote bid and ask prices based on their inventory and market conditions.

- Specialist Market Makers: These market makers are assigned to specific stocks or exchanges and are responsible for maintaining an orderly market.

- Electronic Market Makers: These market makers use algorithms and technology to quote prices and execute trades.

Market Depth and Liquidity, If a market maker posts a quote of 10.00

A market maker’s quote contributes to market depth, which refers to the number of orders available at different prices. Greater market depth indicates more liquidity, allowing for smoother and more efficient trade execution.

A market maker’s willingness to provide liquidity can encourage other market participants to enter or exit positions, further enhancing market depth and liquidity.

Market Impact

A market maker’s quote can influence market prices by attracting or deterring buyers and sellers. If the quote is significantly different from the prevailing market price, it can trigger a shift in supply and demand, leading to price movements.

For example, a market maker posting a lower ask price may encourage buyers to enter the market, potentially driving the price higher.

Regulatory Considerations

Market makers are subject to regulatory frameworks to ensure fair and orderly markets. These regulations may include requirements for:

- Transparency: Market makers must disclose their quotes and trading activities.

- Capital Adequacy: Market makers must maintain sufficient capital to cover potential losses.

- Conflict of Interest: Market makers must manage conflicts of interest between their proprietary trading and market making activities.

Answers to Common Questions: If A Market Maker Posts A Quote Of 10.00

What is the significance of a market maker posting a quote of 10.00?

It indicates their willingness to buy or sell a security at that price, providing a reference point for traders and facilitating order execution.

How does a market maker’s quote affect market depth?

It contributes to the number of orders available at different price levels, influencing the market’s ability to absorb large orders without significant price fluctuations.

What regulatory considerations govern market makers?

Frameworks such as the Dodd-Frank Wall Street Reform and Consumer Protection Act set forth rules to ensure ethical conduct, prevent conflicts of interest, and promote transparency in their quoting activities.